Key Points

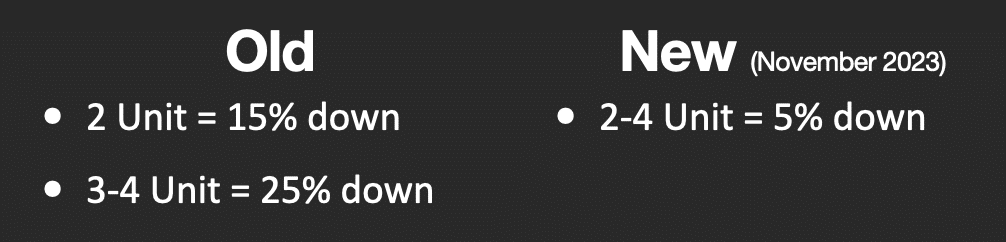

In November 2023, Fannie Mae updated its down payment requirements when buying an owner-occupied 2-4 unit property. The minimum down payment is now only 5% when purchasing a duplex, triplex, or quadplex (fourplex) as long as you live in at least 1 of the units.

This is a significant reduction when considering the minimum down payment was 15% for a duplex and 25% for a triplex or quadplex.

Downpayment requirements for non-owner occupied homes have not changed and remain at 15% and 25% respectively.

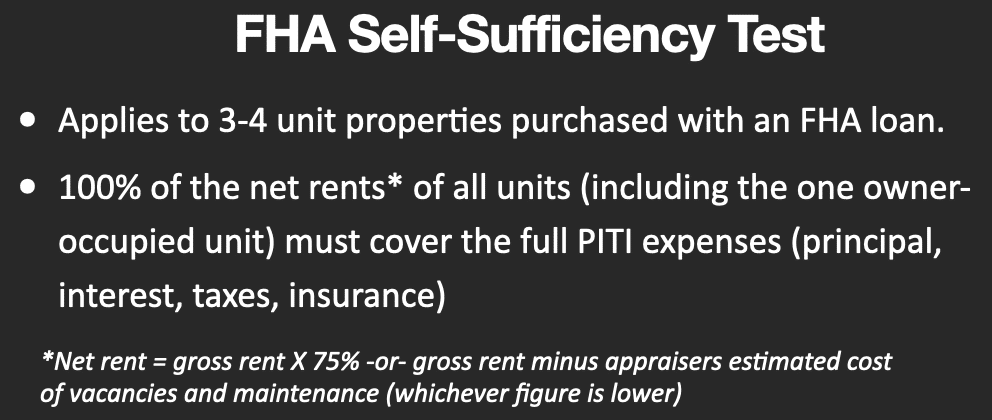

This change is welcomed since the FHA Self-Sufficiency Test applicable to all 3-4 unit properties purchased using an FHA loan made buying a 3-4 unit property in desirable and higher-cost metros, such as Los Angeles, San Diego, etc., not possible due to rising mortgage payment costs and rents that have not risen at the same rate. The FHA Self-Sufficiency Test states that the net rent of all units must be greater than the mortgage payment. Net rent is equal to the gross rent minus the greater of 25% of the gross rent or the appraisers estimated cost of vacancies or maintenance.

Watch our video above for more details on this new loan program update.

Click here to apply for a home loan

~Rob

Mortgage & Real Estate News, Info, and Q&A

100% Facts, 0% Fluff

Quick and concise news, updates, and tips relevant to the mortgage and real estate market delivered in bite-size chunks in 10 minutes or less! Q&A after each presentation.

Attend the live Zoom to ask your questions. Subscribe for invites and to receive the recorded replays. Hosted every 2-3 weeks.

Join the invite list

Robert Breiner. Licensed Loan Officer NMLS# 1199942 | BRE# 01960372 Golden Bear Capital Inc. DBA Click Mortgage | 10174 Old Grove Road Suite 140, San Diego, CA 92131 | Phone: 888-440-3001 | Fax: 888-500-5815 Golden Bear Capital Inc. DBA Click Mortgage (NMLS# 284021) is licensed by the California Department of Business Oversight (CFL License# 603H185) and the California Bureau of Real Estate (License #01847011), Nevada Division of Mortgage Lending License #4043), Utah Division of Real Estate (License #6332409), Washington Department of Financial Institutions (CL-284021).

We are licensed to lend in the following states: Arizona, California, Colorado, Florida, Missouri, Nevada, Texas, Utah, & Washington | NMLS Consumer Access