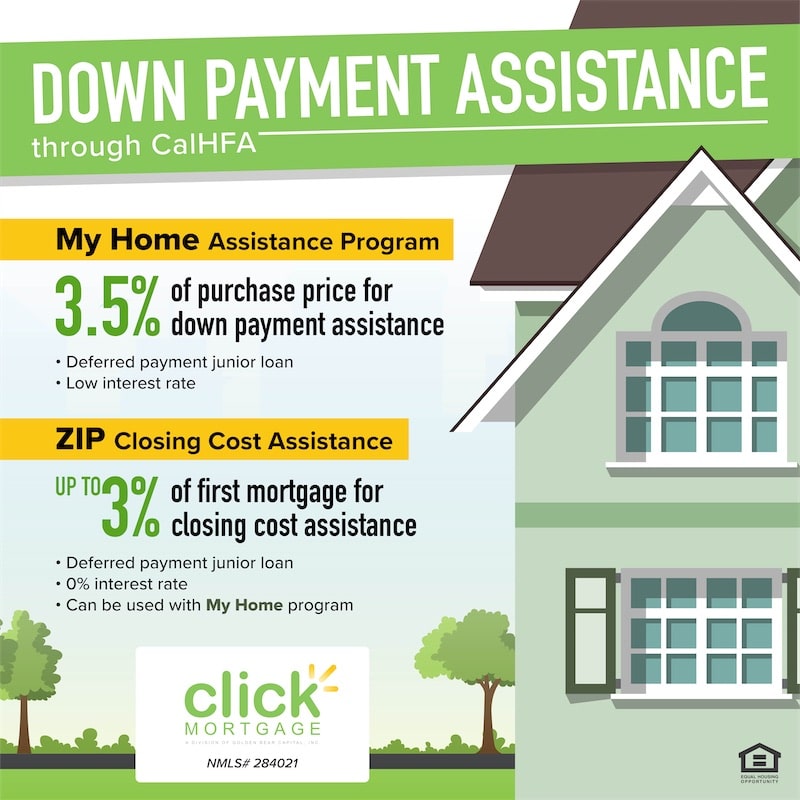

Purchase with CalHFA Down Payment Assistance

How does it work?

CalHFA allows you to purchase a home by financing 100% of the price you pay for a home and can even cover closing costs.

This is achieved by using a standard Conventional or FHA 1st mortgage plus a 2nd mortgage called My Home to finance your down payment and an optional 3rd mortgage called ZIP (zero-interest program) to cover some or all of your closing costs.

Thousands of home buyers use this program every year to purchase a home that ordinarily would have been out of reach due to not being able to save enough for a down payment. Most people who use this program are able to purchase with very little out of pocket, oftentimes only the cost of the appraisal ($600-700) and optional home inspection (about $400).

How do you qualify?

There are some eligibility standards you must meet in order to qualify for this program:

- You must have a 640 or higher credit score. If you’re not quite there, we can likely help you raise your score.

- The buyer’s (non-borrowing spouses not included) income must be less than the County income limit up to $253,000/yr in high-cost Counties.

- You cannot have owned a primary residence in the last 3 years (owning a rental or vacation home is permitted).

Do you pay back the money?

Yes, eventually the money has to be paid back. You do not have any extra payments on the assistance funds while you’re paying your primary mortgage and you only pay back the My Home and Zip loans when you sell the home or pay off your primary mortgage.

Let’s Get Started:

Contact me or click to begin an application to see if you qualify for this or one of our other special loan programs.