Unlocking Homeownership Through CalHFA: The CalPLUS Access Program

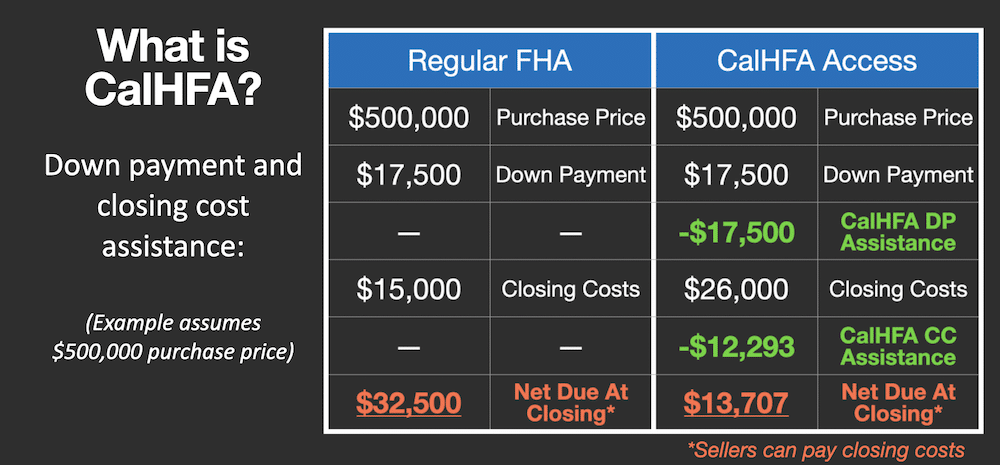

For many first-time homebuyers in California, saving a down payment and closing costs can be a significant hurdle. The California Housing Finance Agency (CalHFA) offers the CalPLUS Access Program to help bridge this gap, making homeownership more attainable.

What is the CalPLUS Access Program?

The CalPLUS Access Program combines a 30-year fixed-rate first mortgage with built-in assistance for down payment and/or closing costs. This assistance comes in the form of a deferred payment junior loan, meaning no payments are required until you sell, refinance, or pay off your first mortgage.

Key Features:

-

FHA or Conventional.

-

$0 Down Payment: Receive up to 3.5% of the sales price as down payment assistance. This assistance is a silent junior mortgage with no monthly payments and is deferred until certain events occur, such as selling or refinancing the home.

-

Closing Cost Assistance: The Access closing costs assistance loan gives buyers additional assistance equal to an additional 2.5% of their loan amount. The Access loan is also a silent junior mortgage with no monthly payments and is deferred until certain events occur, such as selling or refinancing the home.

Eligibility Requirements:

-

Must be a first-time homebuyer (not owned a primary residence in the past three years).

-

Occupy the property as a primary residence.

-

Meet income limits specific to your county.

-

Complete a homebuyer education course through an approved provider.

Why Consider CalPLUS Access?

By reducing the upfront costs associated with purchasing a home, the CalPLUS Access Program empowers eligible Californians to achieve homeownership sooner. It’s an excellent option for those seeking financial assistance without the burden of immediate repayment.

Next Steps:

To explore this opportunity further, consult with a CalHFA-approved lender (yours truly) who can guide you through the application process and determine your eligibility.

Click here to work with me on your next mortgage.

~Rob

Mortgage & Real Estate News, Info, and Q&A

100% Facts, 0% Fluff

Quick and concise news, updates, and tips relevant to the mortgage and real estate market delivered in bite-size chunks in 10 minutes or less! Q&A after each presentation.

Attend the live Zoom to ask your questions. Subscribe for invites and to receive the recorded replays. Hosted every 2-3 weeks.

Join the invite list

Other 10 Minute Mortgage Videos

Purchase A Home With Future Rental Income

Discover how to leverage your existing home's or future home's rental potential when qualifying for a mortgage. This week we discuss how to use your existing home's or potential home's future rental income to increase your pre-approval amount. Whether you're a...

No Income Home Loans

Today we discussed 2 different home loan options that don't require any personal proof of income or employment. The DSCR home loan for investors, and the Community Mortgage for occupant owners (primary or vacation home). DSCR = Debt Service Coverage Ratio Key Points:...

How To Have 2 VA Loans

Early in 2023, the Federal Housing Finance Authority (FHFA) announced some changes to what are called loan level price adjustments (LLPAs). This made conventional loans more expensive and at the same time FHA loans were becoming cheaper after slashing their mortgage...

What Are The Biden Rate Changes

Early in 2023, the Federal Housing Finance Authority (FHFA) announced some changes to what are called loan level price adjustments (LLPAs). This made conventional loans more expensive and at the same time FHA loans were becoming cheaper after slashing their mortgage...

FHA Hacks

FHA loans are quickly becoming the loan of choice for a larger portion of buyers. In this short video I explain why and share some little-known and more obscure facts about FHA loans. Watch the replay to learn about assuming an existing FHA loan, obtaining multiple...

Robert Breiner. Licensed Loan Officer NMLS# 1199942 | BRE# 01960372 Golden Bear Capital Inc. DBA Click Mortgage | 10174 Old Grove Road Suite 140, San Diego, CA 92131 | Phone: 888-440-3001 | Fax: 888-500-5815 Golden Bear Capital Inc. DBA Click Mortgage (NMLS# 284021) is licensed by the California Department of Business Oversight (CFL License# 603H185) and the California Bureau of Real Estate (License #01847011), Nevada Division of Mortgage Lending License #4043), Utah Division of Real Estate (License #6332409), Washington Department of Financial Institutions (CL-284021).

We are licensed to lend in the following states: Arizona, California, Colorado, Florida, Missouri, Nevada, Texas, Utah, & Washington | NMLS Consumer Access